A Long Time Coming: Revising U.S. Coal Reserves

In my previous post I highlighted the recent, quiet admission by the US EIA (in a fine-print footnote to Table 15 of their 2012 Annual Coal Report) that they do not know what fraction of our nation’s large store of coal resources might be economically accessible, and thus potentially classified as reserves.

CEA has long highlighted indications that a revision like this might be in the works, including in our most recent round of coal reports issued last fall (see: Warning: Faulty Reporting of US Coal Reserves). But we’re not the only ones. Plenty of other people have pointed out the same thing over the years. Including…

US Energy Information Administration in 1997

Interestingly, the new footnote text is remarkably similar to statements made by the EIA in their 1997 US Coal Reserves Update:

The usual understanding of the term “reserves” as referring to quantities that can be recovered at a sustainable profit cannot technically be extended to EIA’s estimated recoverable reserves because economic and engineering data to project mining and development costs and coal resource market values are not available. EIA’s recoverable reserves at active mines, about which EIA is authorized to collect simple tonnage and recovery rate estimates in its annual Coal Production Report survey, rely on mine operator estimates, and cannot be classified as to geologic assurance.

This older statement also indicates that even the much smaller pool of coal reserves that the EIA reports as being present at existing mines may not really be reserves, since they do not (or did not) have information about how confident producers were of the coal’s geologic context.

US Securities and Exchange Commission in 2001

In a similar vein, in 2001 the SEC sent a letter to the nation’s publicly traded coal companies admonishing them to stop reporting anything other than their proven reserves in their financial statements, and to instead comply with the rules laid out in Industry Guide 7:

We remind you that under Industry Guide 7, reserves are defined as “[t]hat part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.” This guidance must be followed in reporting reserves in your annual reports. We note that some companies are still reporting “reserve base” estimates, which may contain economic and sub-economic coal deposits. Also, some companies may be reporting non-recoverable or geologically inferred coal deposits in their reserve estimates.

In reporting reserves you are limited to the terms “reserve,” “proven reserves,” and “probable reserves,” as defined in Industry Guide 7. Do not use other terms or systems of reporting reserves, such as “geological reserves,” “demonstrated reserves,” or “reserve base.” Also, reserves must be adequately drilled, sampled and characterized such that the size, shape, depth and coal content is established in accordance with industry criteria for proven and probable reserves.

Given that a mining company’s high confidence, economically accessible reserves are a big part of the business’ overall value, it’s not surprising that the SEC demands decent disclosure.

The US Geological Survey in 2002

Then in 2002 the USGS published its first National Coal Resource Assessment (NCRA). Whereas other agencies had simply been pointing out that the economics of reported coal “reserves” were undefined, the USGS actually attempted to document just how much of the nation’s coal resources might actually be economically recoverable. The preliminary result was less than 20%:

These percentages alone don’t really communicate just how big the disconnect is between what the EIA and the USGS were saying in 2002, because it’s not immediately obvious how the USGS categories above correspond to the EIA’s classification system. Unfortunately, their categories aren’t exactly the same, but here’s a rough guide:

EIA Estimated Recoverable Reserves: excludes coal which is technically inaccessible, unavailable due to land use restrictions, or expected to be lost to mining processes. Prior to the 2012 Annual Coal Report, “economically unattractive” coal was also supposedly excluded. As of the 2012 Annual Coal Report, EIA has said that “this estimate does not include any specific economic feasibility criteria”. Note, however, that the amount of coal included in this category didn’t change.

USGS Recoverable Resources: excludes coal which is unavailable due to environmental or other land use restrictions, or because it is technically inaccessible, and also coal expected to be lost to mining processes.

USGS Economically Recoverable Resources (Reserves): are the subset of the USGS Recoverable Resources (defined above), minus that coal which is deemed too costly to extract.

So when the EIA says that their Estimated Recoverable Reserves are not subject economic criteria, they are comparable to the USGS Recoverable Resources. On the other hand, if the EIA is requiring that the coal be economically extractable for it to be included in Estimated Recoverable Resources, then they are instead comparable to the USGS Economically Recoverable Resources.

Here’s how those categories stacked up in 2002, when the USGS did their National Coal Resource Assessment:

Even if you assume that no economic criteria are involved in the estimates, the USGS number is about half the EIA’s (131 billion tons, vs. 266 billion tons). If instead we assume that the EIA’s Estimated Recoverable Reserves do require the coal to be economically accessible (as indicated in previous Annual Coal Reports) then the EIA and USGS estimates differ by almost a whopping factor of 10!(28 billion tons vs. 266 billion tons).

The USGS again, in 2008

Following on the 2002 National Coal Resource Assessment, the USGS decided to do a much more detailed assessment of the Gillette coal field in Wyoming, which produces ~40% of all US coal. That study was published in 2008, and found that a scant 6% of the original resources were both technically and economically extractable.

Figure 68 in USGS OFR 2008-1202

This 6% of the original coal in place was at the time equivalent to about 10 billion tons:

Figure 67 in USGS OFR 2008-1202

The downward revision was mostly due to the use of a much larger database of well logs from coal bed methane exploration, which showed a significant portion of the previously inferred resources in the basin did not exist.

There’s some obvious (and unfortunate) ambiguity in the EIA’s definition of Estimated Recoverable Resources. As noted above, in 1997 they said it didn’t include any economic criteria. By the early 2000s, the footnotes in Table 15 were saying that “economically unattractive” coal was being excluded. Incredibly, at the same time, in the glossary of the Annual Coal Reports, the EIA was saying:

The term is used by EIA to distinguish estimated recoverable reserves, which are derived without specific economic feasibility criteria

so we might forgive the casual reader for being confused about exactly what the agency meant. Unfortunately, looking at how these numbers end up getting distributed and used, even non-casual readers, like the International Energy Agency, seem to end up confused. In their 2011 World Energy Outlook the IEA reported that the US had 265 billion tons of proven coal reserves, which they define as:

[T]he portion of resources that is known in detail and can be recovered economically, using current technologies. Accordingly, the amount of reserves depends on current international prices, as well as the state of technological progress.

(see IEA WEO 2011 pp. 402-404, as well as table, box and figure 11.3)

The 265 billion ton number is very clearly EIA’s Estimated Recoverable Reserves which as we’ve seen are, at best, of dubious economic viability.

The Congressional Research Service in 2010

Late in 2010 the Congressional Research Service (CRS) prepared a report for Congress explaining US fossil fuel resource terminology and reporting and summarizing major global fuel resources. The CRS pointed out that while the EIA is the authoritative official source for US coal reserve and resource estimates:

For example, in one specific case in Wyoming, 47% of the in-place coal is technically recoverable, but the available, economically recoverable coal is only about 6% of the in-place coal. While these proportions may vary between 5% and 20%, depending upon the specific conditions for each coal-mining area, very large coal numbers are viewed with some caution because in-place numbers, or even recoverable numbers, may not provide a realistic assessment of the coal that could actually be produced. [emphasis added]

This suggests that the CRS felt work done by the USGS was calling the EIA’s very large Estimated Recoverable Reserve numbers into question. The primary difference between the EIA’s reported numbers, and the estimates made by the USGS is whether or not the remaining legally, technically extractable coal can be produced economically. The USGS says most of it can’t, and now the EIA — as of its most recent coal report — says it has no opinion on the matter.

The Coal Industry Itself in 2013

On the other hand, the markets seem to have developed a pretty clear opinion recently: coal production costs are up due to increasing overburden in surface mines and thinner underground coal seams. At the same time coal prices are under downward pressure both from relatively cheap natural gas and increasingly cost-effective renewable energy. The future of carbon pricing in the US is uncertain, but if implemented at even an modest level, it would be a crushing blow to coal as a cost-effective fuel. So profit margins are down, and auctions for new BLM coal leases in the Powder River Basin have been failing. In August Colin Marshall, the CEO of Cloud Peak Energy (which was expected to bid on the Maysdorf II North Tract… which they designed for themselves under the BLM’s Lease By Application or LBA program) said:

“We carefully evaluated the estimated economics of this LBA in light of current market conditions and the uncertainty caused by the current political and regulatory environment towards coal and coal-powered generation and ultimately decided it was prudent not to bid at this time. […] In combination with prevailing 8400 Btu market prices and projected costs of mining the remaining coal, we were unable to construct an economic bid for this tract at this time.”

Just in the last couple of weeks, Oxbow Carbon announced it would be shutting down the Elk Creek coal mine in Colorado. CEO William Koch (brother to the more politically active David and Charles, of Koch Industries) said of the mine closure:

“The coal business in the United States has kind of died, so we’re out of the coal business now. Generally, people and businesses try to do the thing that’s most economical. A lot of the profit has gone out of the coal business.”

Arch Coal, which produced more than 110 million tons in the Powder River Basin (PRB) in 2013, reported in their most recent 10-K that their operating margin in the PRB was just $0.28/ton… which is still a heck of a lot better than the $7.47 operating loss they reported for every ton produced in their Appalachian operations.

In Peabody Energy’s 2013 Q3 earnings call CEO Greg Boyce essentially told industry analysts that at current prices and production costs, it wasn’t worth investing additional capital in the PRB to continue or increase production:

[I]n reality, people have not spent capital to replace equipment that ultimately reached the end of its useful life or spent capital to overcome the annual increase in stripping ratio that naturally occurs in the Powder River Basin.

So the mining capacity overhang in the Powder River Basin is significantly lower than what the nameplate or infrastructure, loading infrastructure and rail infrastructure capacity would be. So I think we are seeing the longer this goes on we are seeing long-term lower productive capacity out of the Powder River Basin until again we see significantly higher price horizons, where people feel like they can make adequate returns for the cost of leasing, developing and buying new equipment…

Nowhere to go but down…

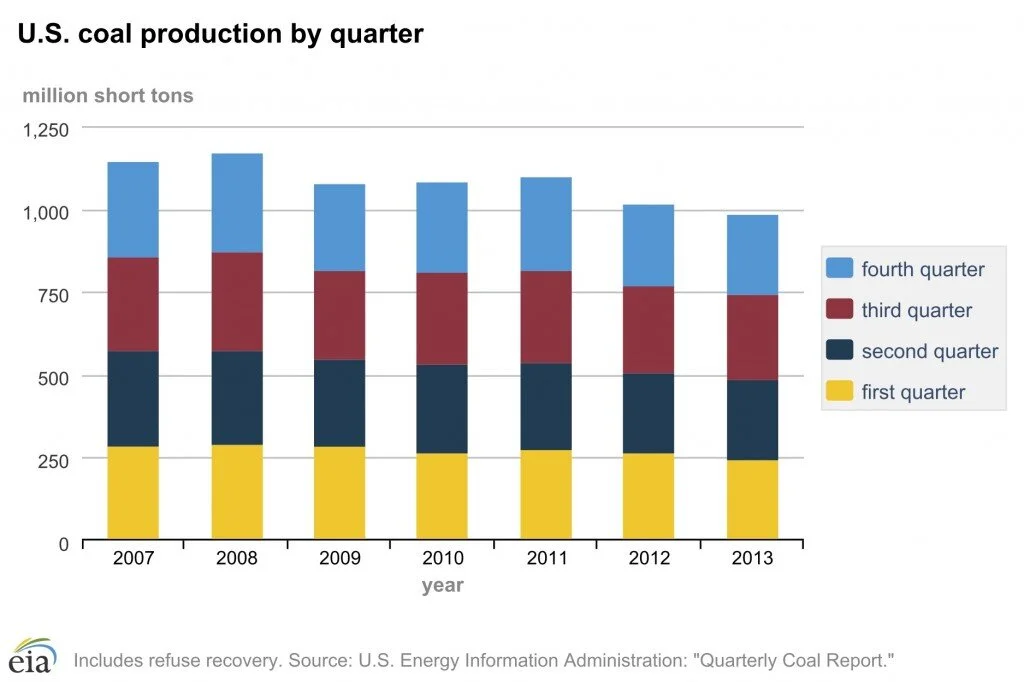

As a result of all these forces, in 2013, for the first time in 20 years, the US produced less than one billion tons of coal:

US Coal Production as of 2013Q4, from the US EIA.

All this would seem to indicate that the USGS was right — that under current market conditions, only a pretty limited subset of our existing, technically and legally accessible coal resources can be produced economically, earning them the title of reserves. If that’s true, then we might expect to see a large downward revision in US coal reserve numbers in the near future, from 258 billion tons of “Estimated Recoverable Reserves” (which were not evaluated for economic recoverability) to something more in line with the USGS’ 2002 estimate of 28 billion tons of economically recoverable resources (aka reserves) — which is nearly a factor of ten less.

Now, for the sake of argument, would a whopping 90% reduction in stated reserves actually be unprecedented? Incredibly, the answer is no! In fact, if you pore over the last couple of decades worth of international coal reserve reporting, you find plenty of massive downward revisions, which I will explore in my next post.

A Long Time Coming: Revising US Coal Reserves

In Good Company: A Brief History of Global Coal Reserve Revisions

Coal Geology vs. Coal Economics & Politics

Image of a drag line in the Hunter Valley, CC-BY licensed via Jeremy Buckingham on Flickr.