Decoupling & Demand Side Management in Colorado

Utility revenue decoupling is often seen as an enabling policy supporting “demand side management” (DSM) programs. DSM is a catch-all term for the things you can do behind the meter that reduce the amount of energy (kWh) a utility needs to produce or the amount of capacity (kW) it needs to have available. DSM includes investments improving the energy efficiency of buildings and their heating and cooling systems, lighting, and appliances. It can also include “demand response” (DR) which is a dispatchable decline in energy consumption — like the ability of a utility to ask every Walmart in New England to turn down their lights or air conditioning at the same time on a moment’s notice — in order to avoid needing to build seldom used peaking power plants.

For reasons that will be obvious if you’ve read our previous posts on revenue decoupling, getting utilities to invest in these kinds of measures can be challenging, so long as their revenues are directly tied to the amount of electricity they sell. Revenue decoupling can fix that problem. However, reducing customer demand for energy on a larger scale, especially during times of peak demand, can seriously detract from the utility’s ability to deploy capital (on which they earn a return) for the construction of additional generating capacity. That conflict of interests is harder to address.

But it’s worth working on, because as we’ll see below, DSM is cheap and very low risk — it’s great for rate payers, and it’s great for the economy as a whole. It can reduce our economic sensitivity to volatile fuel prices, and often shifts investment away from low-value environmentally damaging commodities like natural gas and coal, toward skilled labor and high performance building systems and industrial components.

The rest of this post is based on the testimony that Clean Energy Action prepared for Xcel Energy’s 14AL-0660E rate case proceeding, before revenue decoupling was split off. Much of it applies specifically to Xcel in Colorado. However, the overall issues addressed are applicable in many traditional regulated, vertically integrated monopoly utility settings.

Why can’t we scale up DSM?

There are several barriers to Xcel profitably and cost-effectively scaling up their current DSM programs. Removing these impediments is necessary if DSM is to realize its full potential for reducing GHG emissions from Colorado’s electricity sector. Revenue decoupling can address some, but not all of them.

There are the lost revenues from energy saved, which impacts the utility’s fixed cost recovery. If the incentive payment that they earn by meeting DSM targets is too small to compensate for those lost revenues, then the net financial impact of investing in DSM is still negative — i.e. the utility will see investing in DSM as a losing proposition. Xcel currently gets a “disincentive offset” to make up for lost revenues, but they say that this doesn’t entirely offset their lost revenues.

Even if the performance incentive is big enough to make DSM an attractive investment, the PUC currently caps the incentive at $30M per year (including the $5M “disincentive offset”), meaning that even if there’s a larger pool of cost-effective energy efficiency measures to invest in, the utility has no reason to go above and beyond and save more energy once they’ve maxed out the incentive.

If this cap were removed, the utility would still have a finite approved DSM budget. With an unlimited performance incentive and a finite DSM budget, the utility would have an incentive to buy as much efficiency as possible, within their approved budget, which would encourage cost-effectiveness, but wouldn’t necessarily mean all the available cost-effective DSM was being acquired.

Given that the utility has an annual obligation under the current DSM legislation to save a particular amount of energy (400 GWh), they have an incentive to “bank” some opportunities, and save them for later, lest they make it more difficult for themselves to satisfy their regulatory mandate in later years by buying all the easy stuff up front.

It is of course the possible that beyond a certain point there simply aren’t any more scalable, cost-effective efficiency investments to be made.

Finally and most seriously, declining electricity demand would pose a threat to the “used and useful” status of existing generation assets and to the utility’s future capital investment program, which is how they make basically all of their money right now.

Revenue decoupling can play an important role in overcoming some, but not all, of these limitations. With decoupling in place, we’d expect that the utility would be willing and able to earn the entire $30M performance incentive (which they have yet to do in any year) so long as it didn’t make regulatory compliance in future years more challenging by prematurely exhausting some of the easy DSM opportunities.

What are we doing now?

Here’s the description of Xcel’s current Electric Financial Incentive from their 2013 CO DSM Annual Status Report:

The Commission approved the financial incentive mechanism — which includes a “Disincentive Offset” and “Performance Incentive” — applicable for 2013 electric DSM programs in Proceeding No.10A-554EG (Decision C11-0442). A Disincentive Offset of $3.2 million (grossed up for income taxes) is awarded when Public Service achieves 80% of the annual energy savings goal. The Disincentive Offset increases to $5.0 million when Public Service achieves 100% of the annual energy savings goal. The Performance Incentive is 1% of net economic benefits when the Company achieves 80% of the annual energy savings goal, and escalates to 2% at 85 % of the energy savings goal, 3% at 90% of the energy savings goal, 4 % at 95% of the energy savings goal, and [the performance incentive] is 5% [of the net economic benefit] at 100% of the energy savings goal. The Performance Incentive share of net economic benefits continues in a pattern where each 5% increase in energy savings achievement above 100% achievement of the annual energy savings goal results in a 1% addition to the Company’s share of net economic benefits, up to a maximum of 15% at 150% of goal. The combination of the pre-tax Disincentive Offset and the Performance Incentive may not exceed $30 million. That total financial incentive is recovered in the year following the 2013 performance year.

Admittedly, it’s about as clear as mud, but let’s try and pick it apart.

There are two different achievements being tracked:

the amount of energy saved (as a percentage of a goal set by the PUC), and

the net economic benefit that results from saving that energy.

There are also two different rewards being calculated:

the “Disincentive Offset” which has a well defined dollar value, based on how much energy has been saved (relative to the PUC’s goal) and

the “Performance Incentive” which is calculated as a percentage of the net economic benefits — and that percentage increases as the amount of energy saved increases (again, relative to the PUC’s goal).

The structure of these incentives is problematic in a couple of ways. They don’t encourage the utility to be cost effective and they don’t fully scale with the amount of energy saved.

The Disincentive Offset is a crude way of compensating the utility for lost revenues due to lower energy sales, but it only applies to the base savings target — once the utility has surpassed their regulatory mandate, it drops away, forcing the Performance Incentive to take over and do both the job of protecting the utility from lost revenues, and providing them with a financial incentive to keep saving energy beyond their mandate.

The Disincentive Offset also depends only on the fact that a certain amount of energy was saved, not how cost effectively it was saved. DSM program costs are passed through to ratepayers directly, so the utility has no incentive to care about being cost effective until, at the very least, they’ve done enough DSM that they start earning the Performance Incentive.

Because the Performance Incentive is a percentage of the net economic benefits, in theory it does encourage the utility to do cost effective things first — since that would result in more economic benefits, which they get a cut of. But if the lost revenues from reduced sales aren’t being fully covered by the disincentive offset, it may still be a losing proposition (for Xcel!) to be aggressive on investing in efficiency.

The result is that the utility begrudgingly complies with the regulatory mandate, and meets their energy savings targets, without really going above and beyond to aggressively pursue the performance incentive, never getting close to hitting the incentive cap, and complaining constantly, while trying to get out of the obligation in future years.

WWDD: What Would Decoupling Do?

With revenue decoupling in place, the utility would no longer have to worry about the lost revenues part of this equation, and would be motivated to invest in DSM measures that are at least cost effective enough to earn the entire approved performance incentive, without spending more than their approved DSM budget. They wouldn’t have an incentive to be any more cost effective than that because the DSM program costs are recovered directly from ratepayers, and the performance incentive is capped. Nevertheless, with revenue decoupling in place, if Xcel proved willing and able to earn the entire performance incentive, then we’d expect the overall cost effectiveness of the DSM program to improve relative to years past.

But as we already mentioned, there’s another issue discouraging the utility from earning the entire performance incentive and surpassing their mandated minimum DSM targets. If Xcel expects to be subject to a DSM requirement each year into future, then it may be worthwhile for them to avoid cannibalizing future cost-effective DSM opportunities by taking advantage of them in the current year, since that would make future regulatory compliance more challenging.

This situation is similar to the one faced by Colorado utilities complying with the state’s renewable energy standard (RES — sometimes called a renewable portfolio standard or RPS in other states). In the case of the RES, utilities are allowed to “bank” renewable power generated in excess of low, early requirements, and count them against later, higher requirements. If the commission were to adopt the proposed revenue decoupling mechanism in the hopes that the utility would invest in achieving energy and capacity savings above and beyond the required minimum, then it would probably be a good idea to explore a similar “banking” mechanism for DSM compliance.

(Alternatively, the incentive could be structured such that marginal additional energy savings beyond the target in the current years are enough more valuable than savings counting toward base compliance in a future year that the utility is willing to save the energy now, even if it does make compliance more challenging later.)

Encouraging Cost Effective DSM First

In order for the utility to preferentially pursue the most cost-effective DSM opportunities, then in addition to revenue decoupling and allowing the utility to bank their DSM achievements against future regulatory requirements, we need to ensure that their performance incentive scales with the level of savings they achieve. This could be done by removing the cap on the performance incentive they are allowed to earn in any given year. Then they’d have an incentive to maximize the accrued net economic benefits, a fraction of which they are entitled to retain, while limiting spending to the approved DSM budget. In effect, removing the cap on the performance incentive and approving a fixed DSM budget would tell the utility: “Buy as much energy and capacity savings as you possibly can within this budget. The more savings you can find, the more money you get to keep.”

Are “unlimited” incentives dangerous?

If (and this is admittedly a big if) the net economic benefits and cost effectiveness metrics being used by the utility accurately reflect the costs and benefits resulting from DSM programs, then removing the performance incentive cap would pose little risk to ratepayers. Overall utility DSM spending would still be constrained by the approved budget, and under the currently adopted performance incentive policy a large majority of any economic benefits flowing from avoided energy and capacity costs would accrue to the ratepayers, not the utility.

These changes would provide a more powerful incentive for the utility to expand the net economic benefits associated with their DSM investments. As a result, in order to protect ratepayers it would become more important to ensure that utility estimates of economic benefits are accurate, and not subject to inflation or manipulation. Increased transparency and regular, independent, external auditing of those calculations would be important.

Why is DSM good for ratepayers?

DSM investments share many of the benefits of distributed generation, including highly predictable long-term costs and reduced spending on transmission and distribution system capacity. DSM is also just plain cheap compared to many of the alternatives, according to Xcel’s own DSM annual reports, which we’ve compiled some data from in these tables:

Avoided Energy Costs:

Data: PSCo DSM Annual Reports

Avoided Capacity Costs:

Data: PSCo DSM Annual Reports

Between 2009 and 2013 the total cost per avoided unit of energy demand ranged from $0.025/kWh in 2009 to $0.033/kWh in 2013. This is admittedly a slightly simplified calculation — we’re not discounting the future savings that accrue from investing present dollars in DSM — but plenty of customers make decisions based on “simple payback” times, so it’s still relevant.

With these assumptions, DSM is much cheaper than retail rates on a per kWh basis, and competitive in many cases with just the production costs of fossil fuel based generation on PSCo’s system, which overall were $0.036/kWh in 2013. This is true despite the fact that we currently fail to effectively price the risk associated with variable future fuel prices, GHG emissions, and public health impacts. The fact that DSM is competitive with variable operating costs alone means that investing in it makes sense even if all it allows us to do is idle already existing generation facilities. Of course this also means that DSM is much cheaper than the retail rates that customers pay.

Source: PSCo FERC Form 1 filings and Annual DSM reports

Breaking down the production costs by fuel and power plant type, we can see that DSM has been significantly cheaper than even the recently cheap gas and comparable to coal — again, just on the basis of the operating costs, ignoring externalities, price risks, and fixed costs:

Source: PSCo FERC Form 1 filings and Annual DSM reports

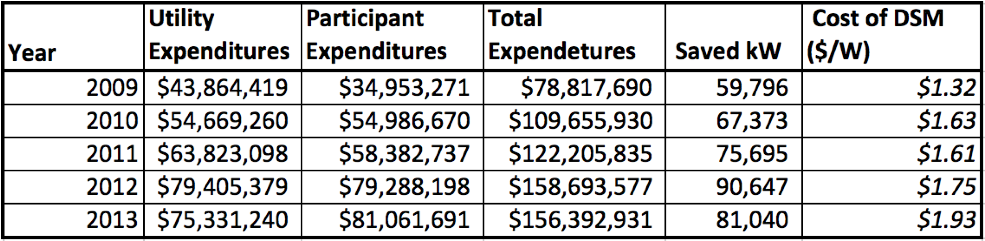

But of course, we don’t just save energy with DSM, we also avoid the need for additional generation capacity. The cost per unit of avoided capacity ranged from $1.32/W in 2009 to $1.93/W in 2013. This means DSM was cheaper on a capacity basis than any other resource except for natural gas, but without being exposed to the fuel risks and externalities associated with natural gas:

When we compare the cost of DSM to retail rates — which do include all the fixed costs (but still do not price fuel risks or externalities) DSM is a screaming deal:

Source: PSCo DSM Annual Reports (2009-2013) & Retail Rates

But isn’t DSM getting more expensive?

Xcel and the PUC use something called the Modified Total Resource Cost (MTRC) to measure how cost effective a given DSM measure is — as well as to measure the cost effectiveness of the entire program. It’s the ratio of an investment’s overall economic benefits to its overall economic costs (B/C) which means a bigger number is better. The MTRC includes money invested by both the utility and the customer in the costs, and savings that accrue to the customer on their bill as well as the value of avoided capacity investments by the utility in the benefits — though of course since the utility actually makes their profits by spending money on things like generation capacity, they probably don’t actually think of that as a “benefit” internally. (If you’re really into it, you can learn more about this and other cost tests from this EPA paper.)

According to PSCo’s annual DSM reports, the modified total resource cost (MTRC) benefit to cost ratio has declined from more than 4.07 in 2009 to 2.30 in 2013. This downward trend would seem to suggest that the most cost-effective DSM opportunities are being preferentially exhausted by the utility.

But as described above, Xcel currently lacks a clear financial incentive to invest preferentially in the most cost-effective DSM opportunities. Given the company’s position that lost margins from reduced electricity purchases outweigh the existing performance incentives, their motive is primarily one of regulatory compliance — meeting the mandated DSM targets within the approved DSM budget. They have no opportunity to make more money by being more cost effective.

Indeed, if the Company believes that DSM programs are a net financial drag on their earnings, they have every incentive to construct a credible narrative that leads to the program eventually being discontinued. This isn’t to suggest that any such manipulation is actually occurring — only that in the absence of rigorous, independent, and transparent DSM program auditing, it might be possible, and would appear to be aligned with the company’s current financial interests. As a result, the observed trend in the cost of the company’s DSM programs provides us with little information as to the scope and cost-effectiveness of DSM investments that remain available.

What if there’s no more cheap DSM?

The whole point of giving the utility a scalable incentive to pursue the most cost-effective DSM is to harness their greed in the service of making our energy system more efficient. If they don’t have an incentive to find lots of DSM opportunities, and they don’t have an incentive to be as cost effective as possible — if instead they see investing in efficiency as a net financial drag on their business — then it shouldn’t be surprising if they have a hard time finding attractive investments. Without profits at stake, it’s just not interesting to them.

At the same time, the supply of cost-effective DSM opportunities is unavoidably finite. We can’t conserve all the way to zero. So there is a fundamental constraint on the role DSM can play in de-carbonizing the energy services provided by the electricity sector. However, unless businesses are empowered to profit from finding and exploiting these opportunities, we are unlikely to realize their full potential. We don’t pretend to know the full scope of available DSM. What we’re suggesting here is that it is in the public’s best interest pay the utility to figure out just how far DSM can be taken. If effective, scalable incentives are implemented, then eventually we will run up against the fundamental constraint of DSM availability, and it can be addressed in a future DSM strategic issues proceeding.

But our guess is, if it can be made a profit center for the utility, we’ve got a long way to go before that happens.

The Elephant in the Room. Is it sitting on a ratepayer? CC-BY-SA by David Blackwell, via Flickr.

The Elephant in the Room

In the context of climate change, even if we were able to create a scalable, cost-effective DSM program with all the right incentives, and even if there are billions of dollars worth of DSM that’s cheaper than generating electricity, there’s a much more fundamental incentive problem in the way Colorado’s utilities are structured today.

The old adage that “You’ve got to spend money to make money.” is spectacularly true for regulated monopoly utilities like Xcel. Their profits overwhelmingly come from putting big capital investments into the rate base — they’re very close to simply getting a guaranteed, long-term return on whatever money they’re able to spend on capital projects. Which is another way of saying: the more they spend, the more they “earn.”

This means that the existence of a large amount of cheap DSM is actually a liability to the utility — going after it could displace lucrative potential capital investments in new generation, or capital improvements to extend the lives of existing plants.

How can we possibly work around this issue? How can we shut down carbon intensive plants that are already on the system, consistent with a 2°C emissions pathway? How can we make space on the grid for massive investments in renewables and efficiency? Who ends up absorbing the cost of those plants we’ve decided are unsafe to operate because of their climate impacts?

All hard questions worth asking, that we’ll take a look at in our next post!

Featured image of a super efficient Philips LED bulb courtesy of John Loo under a Creative Commons Attribution license, via Flickr